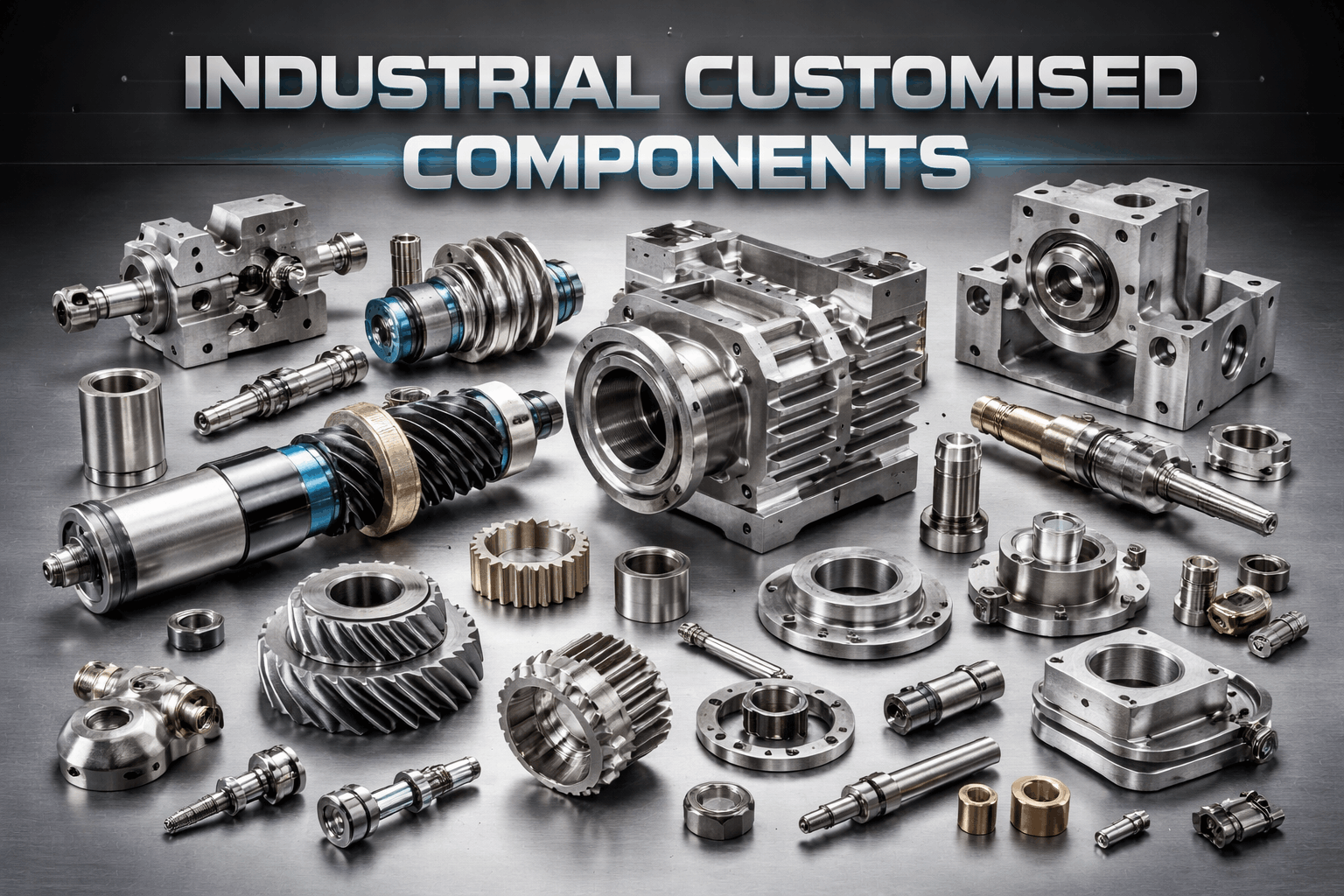

Splendid Industries: Industrial Customised Components

In an era defined by rapid technological advancement and increasingly specialized manufacturing demands, the capacity to deliver customised industrial components has become a strategic advantage. Splendid Industries — used here as a conceptual exemplar rather than a specific organization — epitomizes the evolution of manufacturing from mass-production uniformity toward precision-tailored solutions. This essay examines the role and significance of customised components in modern industry, the technologies and processes enabling bespoke production, design and quality considerations, supply-chain and economic impacts, sector-specific applications, and the strategic imperatives for companies that seek to remain competitive by offering customised industrial components.

The Rise of Customisation in Industry

Market forces and technological opportunities have shifted the competitive landscape. Customers across sectors now expect products and systems that precisely meet performance, regulatory, and integration requirements. This demand has been driven by several factors:

Diversification of applications: New industries and novel use-cases (e.g., renewable energy installations, medical devices, semiconductor fabrication) require components that depart from off-the-shelf norms.

Performance optimization: Tailored components often enable better energy efficiency, higher throughput, or longer life cycles than generic parts.

Integration complexity: Modern systems frequently require components that fit into bespoke mechanical, electronic, or software ecosystems.

Regulatory and safety compliance: Critical industries (aerospace, medical, automotive) impose stringent standards that necessitate design adaptations.

Competitive differentiation: Manufacturers and system integrators use custom components to deliver unique functionality and build intellectual property.

Consequently, businesses like Splendid Industries that specialize in industrial customised components occupy a pivotal position, acting as problem-solvers for original equipment manufacturers (OEMs), integrators, and end-users.

Core Technologies and Manufacturing Processes

The capability to deliver customised components rests on an ecosystem of design tools, manufacturing technologies, and process controls. Key enabling technologies include:

Computer-Aided Design (CAD) and Simulation: High-fidelity CAD, coupled with finite element analysis (FEA) and computational fluid dynamics (CFD), allows engineers to iterate designs rapidly, predict behavior under operational stresses, and optimize geometries for function and manufacturability.

Additive Manufacturing (AM): Also known as 3D printing, AM enables production of complex geometries, internal channels, and lattice structures that are difficult or impossible with traditional methods. For low-to-medium volume bespoke parts, AM reduces lead times and tooling costs.

Precision Machining and CNC: Computer Numerical Control (CNC) machining remains indispensable for high-precision metal and polymer components. Multi-axis machining techniques facilitate intricate forms with consistent tolerances.

Sheet Metal and Fabrication Techniques: Laser cutting, bending, welding, and forming are essential for enclosures, chassis, and brackets tailored to specific assemblies.

Surface Treatments and Coatings: Plating, anodizing, painting, and engineered coatings contribute to wear resistance, corrosion protection, and electromagnetic compatibility — often critical for customised applications.

Microfabrication and MEMS Processes: For micro-scale components or sensors, photolithography, etching, and surface micromachining enable customised microsystems.

Electronics and Embedded Systems Integration: Customised electromechanical components increasingly embed sensors, control electronics, and communication modules, necessitating capabilities in PCB design, component sourcing, and firmware development.

Quality and Metrology Tools: Coordinate measuring machines (CMM), optical inspection systems, and in-line process monitoring ensure that customised components meet specified tolerances and functional requirements.

These technologies, when integrated within an agile manufacturing environment, enable firms to handle customer-specific designs efficiently while maintaining quality and cost-effectiveness.

Design Considerations for Customised Components

Delivering an effective customised component requires a disciplined design process that balances innovation with practicality. Important considerations include:

Requirement Analysis: Understanding operational environment, functional requirements, regulatory constraints, and interfaces with other system elements is the foundational step.

Design for Manufacturability (DFM) and Design for Assembly (DFA): Even bespoke parts must be manufacturable at acceptable cost and yield. Early engagement between designers and manufacturing engineers minimizes iteration.

Material Selection: Material properties (strength, fatigue resistance, thermal behavior, chemical compatibility) must match application demands. Material availability and supply chain resilience are also key.

Tolerance and Fit: Clear definition of tolerances impacts performance and interchangeability. Critical dimensions should be identified and controlled tightly, while non-critical dimensions can have relaxed tolerances to reduce cost.

Lifecycle and Maintainability: Custom components should consider maintenance access, repairability, and eventual recycling or disposal, aligning with customer maintenance practices and sustainability goals.

Standardization Opportunities: Even in bespoke programs, reusing modular subcomponents or adhering to standard interfaces reduces complexity and cost across multiple customised designs.

Validation and Testing: Prototyping, accelerated life testing, environmental testing, and functional verification ensure that the part fulfills its intended role under real-world conditions.

Quality Management and Certification

Industries that rely on customised components often impose rigorous quality and certification demands. A professional provider must implement robust quality systems and be prepared to demonstrate compliance through documentation, traceability, and testing:

Quality Management Systems: ISO 9001 remains a baseline; for aerospace and medical sectors, AS9100 and ISO 13485 are typical requirements.

Traceability: Material certificates, lot control, and process documentation enable root-cause analysis and compliance with regulatory audits.

Non-Destructive Testing (NDT): Techniques such as ultrasonic testing, X-ray, dye penetrant, and magnetic particle inspection validate internal and surface quality without damaging parts.

Statistical Process Control (SPC): Continuous monitoring of production metrics helps maintain consistency across customised builds.

Certification and Approval Processes: Some industries require component-level certification or supplier qualification programs. Meeting these demands strengthens market access.

Supply Chain, Cost, and Time-to-Market

Customisation introduces trade-offs in supply chain management, pricing, and delivery. Key dynamics include:

Tooling and Setup Costs: Custom parts often incur upfront costs for tooling, fixtures, or patterns. Additive manufacturing can reduce these costs for small batches.

Economies of Scale: Low-volume bespoke production limits per-unit economies. Providers must optimize processes and materials sourcing to remain competitive.

Lead Times: Rapid iteration and short lead times are competitive differentiators. Techniques like digital twins and concurrent engineering accelerate development.

Supplier Networks: Strong supplier relationships, redundancy, and material alternatives mitigate risks from single-source dependencies.

Inventory and Obsolescence: Custom components can create spare-parts inventories. Designing for component commonality can reduce long-term cost exposure.

Pricing Strategies: Transparent costing models that separate one-time engineering charges from per-unit production costs help customers evaluate trade-offs.

Applications Across Industry Sectors

Customised industrial components find application across a broad spectrum of sectors. Representative examples include:

Aerospace and Defense: Lightweight structural components with optimized strength-to-weight ratios, bespoke fasteners, and mission-specific avionics housings.

Automotive and Mobility: Custom brackets, hybrid-powertrain components, sensor mounts, and tooling for low-volume specialty vehicles.

Medical Devices and Healthcare: Patient-specific implants, surgical instruments, and bespoke housings for diagnostic equipment — requiring strict biocompatibility and sterilization considerations.

Energy and Renewable Technologies: Turbine blade adaptors, bespoke connectors for offshore installations, and specialized heat-exchanger components.

Semiconductor and Electronics Manufacturing: Precision fixtures, wafer-handling components, and customised enclosures for cleanroom equipment.

Industrial Automation and Robotics: Custom end-effectors, fixtures, and sensor integration modules tailored to specific automation tasks.

Construction and Heavy Machinery: Wear-resistant components, customized hydraulic manifolds, and structure-specific brackets.

Each sector imposes unique constraints; successful suppliers align capabilities to the specific regulatory, environmental, and performance needs of the target industry.

Strategic Implications for Manufacturers

Manufacturers offering customised components must adapt strategically in several dimensions:

Focus on Capabilities, Not Just Volume: Investing in engineering talent, simulation tools, and flexible manufacturing platforms enables responsiveness to bespoke demands.

Co-development and Partnership Models: Early collaboration with customers reduces risk and shortens development cycles. Value-added services — such as design consultation, prototyping, and lifecycle support — create stickiness.

Technology Adoption: Embracing digital manufacturing, IoT-enabled production monitoring, and advanced automation reduces cost and enhances repeatability for customised runs.

Intellectual Property and Competitive Edge: Custom solutions can create proprietary advantages. Companies must balance IP protection with customer needs and potential collaboration benefits.

Sustainability and Circularity: Increasingly, customers expect sustainable sourcing and design for recyclability. Custom components should reflect these priorities.

Talent and Organizational Structure: Cross-functional teams that blend design, materials science, manufacturing engineering, and quality assurance are essential.

Challenges and Risk Management

Customisation introduces complexity and risks that must be managed proactively:

Cost Overruns and Scope Creep: Clear contractual terms, change-control processes, and milestone-based payments mitigate financial risk.

Technical Uncertainty: Prototyping, simulation, and phased testing help validate designs before committing to full production.

Supply Disruptions: Dual-sourcing, inventory buffering of critical materials, and local supplier development reduce vulnerability.

Regulatory and Liability Exposure: Robust testing, compliance documentation, and insurance coverage are necessary in regulated industries.

Scalability: Transitioning from prototype to production requires careful planning to maintain quality while scaling capacity.

Case Example (Conceptual)

Consider a manufacturer of robotic arms that requires bespoke end-effectors for a new assembly line handling fragile composite components. Off-the-shelf grippers either damage parts or lack the reach to operate within tight assemblies. A supplier like Splendid Industries would:

Conduct requirement analysis and on-site evaluation.

Develop CAD models and run FEA to optimize the gripper geometry for gripping force distribution and weight.

Prototype using additive manufacturing for rapid validation.

Iterate based on functional tests, then finalize designs for hybrid manufacturing: CNC-machined structural elements combined with AM-produced complex contact surfaces.

Apply specialized soft-surface coatings for part protection and integrate embedded sensors for force feedback.

Deliver documentation, test reports, and a lifecycle support plan including spare parts and maintenance guidelines.

Great Technology

Greater Digitalization: Digital twins, cloud-based collaboration, and enhanced simulation fidelity will reduce development cycles and improve first-pass success rates.

Delivery On Time

Wider Adoption of Additive Manufacturing: Continued material and process advances will make AM viable for more structural applications and larger volumes.

Certified Engineers

Embedded Intelligence: Components with integrated sensors and connectivity will enable condition-based maintenance and performance optimization.

Best Branding

Increased Sustainability: Demand for recycled materials, energy-efficient manufacturing, and design for disassembly will influence material choices and product lifecycles.

Planning & Strategy

Mass-Customisation Platforms: Scalable platforms enabling parametric customization will allow customers to configure components within validated design envelopes, blending custom fit with predictable cost and performance.

-

Engineering & Builders

-

Metal Factory & Engineering

-

Robotics & Oil Industry

-

High Rated Load

-

Globally Stable Partner

Any questions? We're here to help...

Proactively envisioned multimedia based expertisee cross-media growth strategies. Seamlessly visualize quality intellectual capital without superior collaboration and idea-sharing.

Proactively envisioned multimedia based expertisee cross-media growth strategies. Seamlessly visualize quality intellectual capital without superior collaboration and idea-sharing.

Proactively envisioned multimedia based expertisee cross-media growth strategies. Seamlessly visualize quality intellectual capital without superior collaboration and idea-sharing.